UNCLE

YEAR

ROLE

Product Manager

INDUSTRY

Live Life On Your OwnTerms With Uncle

ABOUT

Providing a hassle-free, reliable, and efficient alternative to traditional loan providers. With Uncle advanced technology and algorithms, they were able to process loan applications quickly and efficiently, giving users access to the funds they need without the typical delays or paperwork required by traditional lenders.

Introducing Sprout

Raised over $50k angel investments with designs

Uncle is a mobile app that uses machine learning algorithms to predict and assign loans to salary earners. The app is designed to simplify the loan application process for users and provide access to fast and reliable credit. Uncle leverages the power of machine learning to analyze user data and predict their creditworthiness accurately. By doing this, the app can provide loans quickly and at a competitive interest rate.

Loans made simple, so you can focus on what matters most.

Discovering a Problem

The founders of Uncle, Jesse and Anu, were both employees of a bank and had firsthand experience of the challenges that people face when trying to access credit. They noticed that the traditional approach to loan applications was outdated and often left people stranded without access to credit. This situation was especially problematic for salary earners, who often found themselves unable to get loans due to strict lending policies.

Building a a loan app with a very tech interface, or so she said...

They did their background work, so I dont have to, lol

The founders created personas to help them better understand their target audience. They identified two primary personas: the first was a young professional who had just started their career and needed access to credit to help them build their credit history. The second persona was a more established employee who needed access to credit for emergencies, unexpected expenses, or other needs.

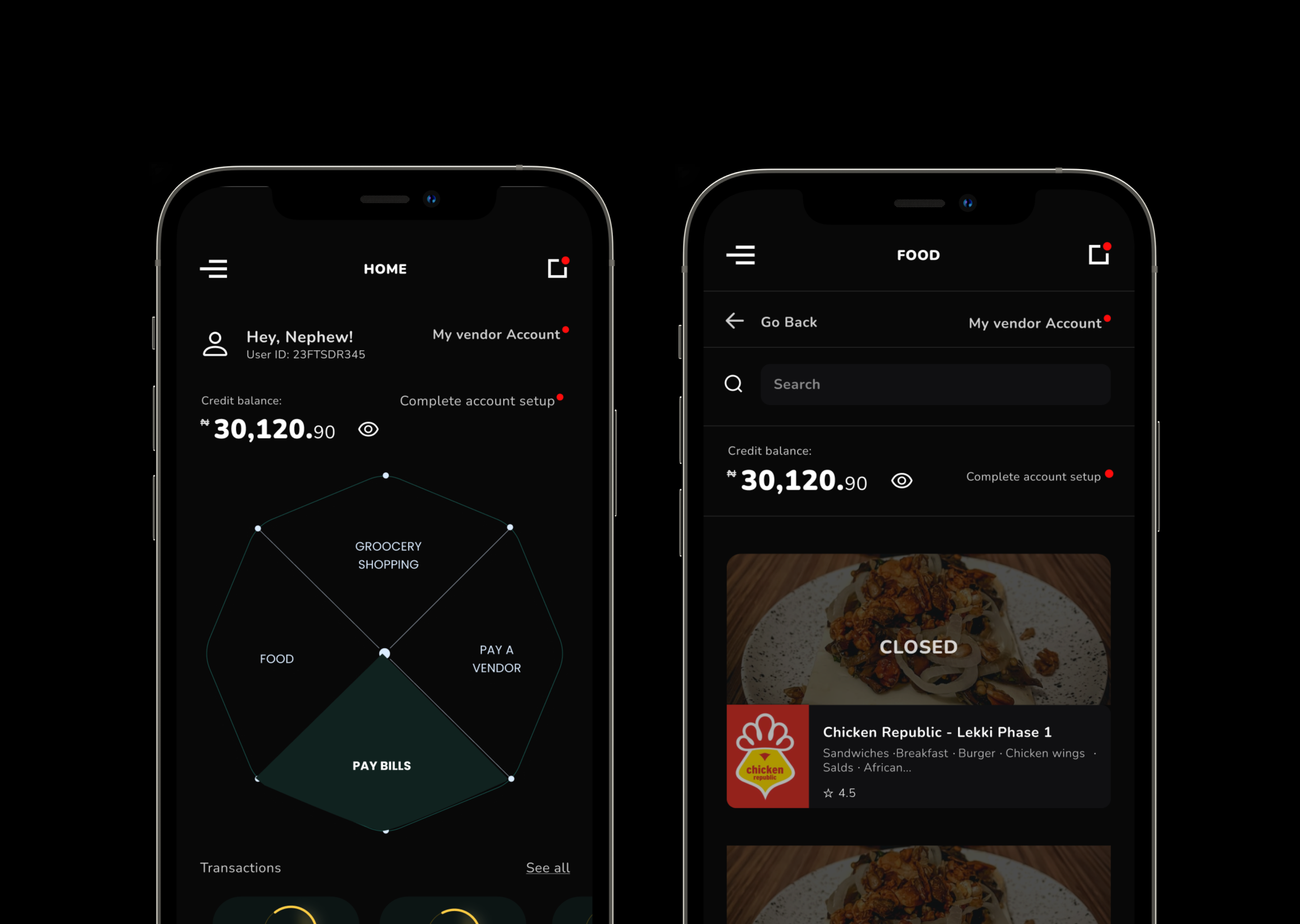

User dashboard was designed and ideated

Short user flow for uncle build up process

We were also able to get leads on other competitive apps that these people were either currently using, or had previously tried before.

I also noted down the functions that could be improved on and market opportunities in which they were currently lagging.

Insights

We began researching the lending industry and discovered that many people struggled to access credit due to the stringent requirements set by banks and other financial institutions. They also found that many people were turning to informal lenders who charged exorbitant interest rates, trapping them in a cycle of debt. These insights gave them an idea for a solution that would leverage technology to solve the problem.

Users just did not want the long process involved in getting a loan and we aimed to solve it

We used a customer journey map to organize the themes gotten from research and mapped out the flow of the users’ interaction with the application

Website

CLEAR VISION

The website came with a dynamic fill that gives users the direct idea about sprout and its value proposition.

Dynamic website for users to understand the companys value propositions and product offerings.

Designs

Logos and all brand asset were created by me.

Overall this was an interesting project that took me in a different design direction, thinking of businesses as direct chain customers. The total design project took 3 months to complete and handover.